Read 29 Insly reviews and testimonials from customers, explore 25 case studies and customer success stories, and watch 12 customer videos to see why companies chose Insly as their Insurance Agency Management

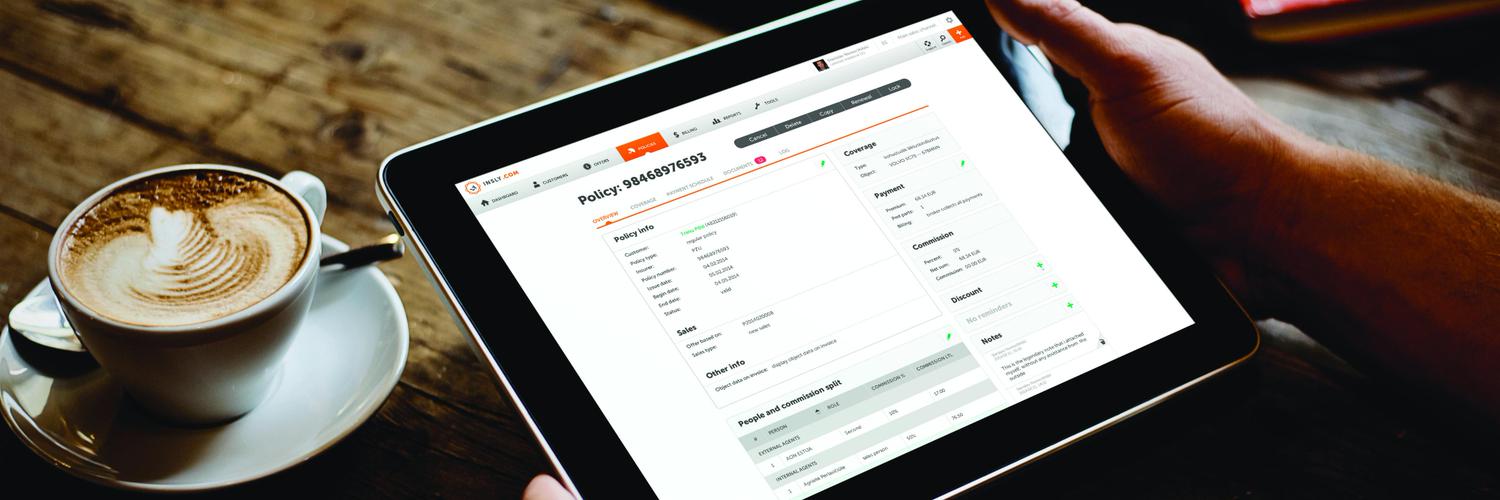

Insly is on a mission to give every insurer and broker access to enterprise-grade software, without the financial risk of prohibitive upfront costs or long implementation cycles. Founded in 2013 by Risto Rossar, Insly combines deep insurance expertise with flexible, modular technology designed around the needs of MGAs and insurers. Its solutions span the entire insurance lifecycle - from product development and underwriting to finance, accounting, and AI innovation. Fast to implement and priced for growth, Insly helps insurance businesses scale with confidence.

Show more